Understanding the Budget Behind the Bills

In District 7 — encompassing Roxbury, parts of Dorchester, the South End, and Fenway — residents often ask:

“Why are my property taxes so high?”

“Where does all this money go?”

“Why does it feel like we pay more but get less?”

These are real questions — and they deserve real answers.

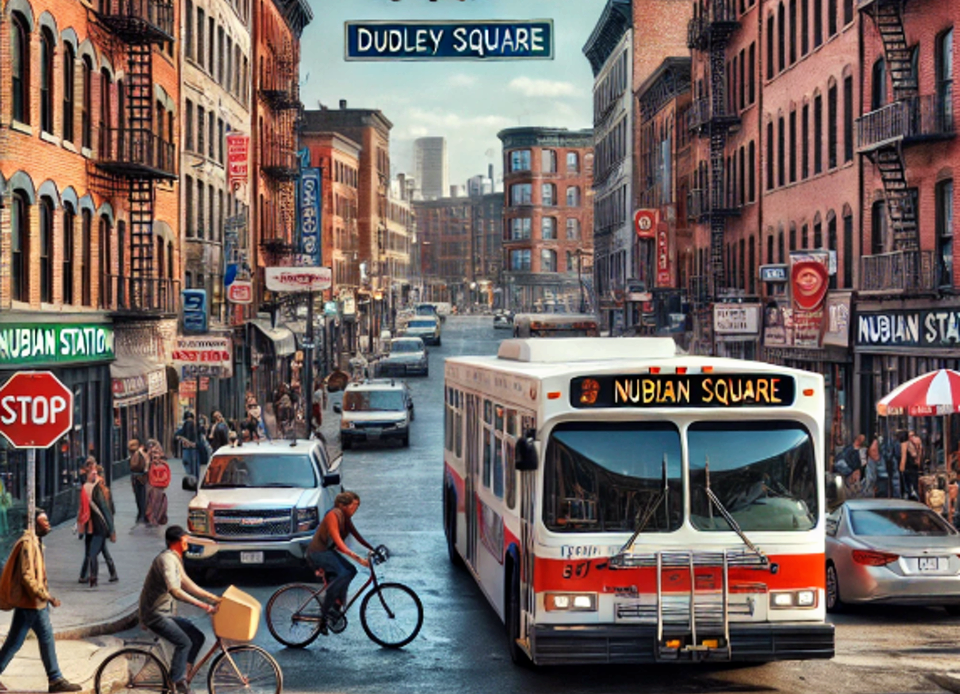

Whether you own a triple-decker in Roxbury, rent an apartment in the South End, or run a small business in Nubian Square, the city’s tax system directly affects your quality of life.

Understanding where your tax dollars go isn’t just about transparency — it’s about power.

When you know how the system works, you can hold it accountable, shape priorities, and fight for equity in District 7.

What Are Boston’s Main Taxes?

Boston, like other Massachusetts cities, collects revenue primarily from three sources:

1. Property Tax (72% of revenue)

-

Collected from all taxable real estate — homes, condos, apartments, businesses.

-

Based on your property’s assessed value, not just what you paid for it.

2. State Aid (13%)

-

Includes education funding, public safety support, and other state transfers.

3. Other Local Revenues (15%)

-

Excise taxes on vehicles

-

Building permits, parking tickets, licenses, fines, etc.

Note: Boston does not have a local sales or income tax — those are collected at the state level.

Clarifying Fact:

While the Police, Fire, and EMS budget is one of the largest individual categories, critical community investments — such as housing, public health, libraries, parks, and youth services — are often divided among multiple smaller categories.

When combined, these services may exceed the public safety allocation, but individually, no single category (except Boston Public Schools) currently matches or surpasses the city’s spending on policing.

This breakdown matters because it shows that large amounts are committed to public safety, while investments in affordable housing, public health, parks, and youth development require sustained and often increased advocacy to secure funding.

Why Are Property Taxes Going Up in District 7?

Gentrification and Reassessments

-

As home values rise in parts of Roxbury, Dorchester, and the South End, so do assessments.

-

Even if you’re not selling your home, your tax bill can increase if nearby properties sell at higher prices.

Limited Commercial Base in Some Areas

-

Downtown Boston and the Seaport generate a huge share of tax revenue from office towers and hotels.

-

In District 7, which has more residential than commercial property, homeowners bear a higher tax burden.

Exempt Properties

-

Boston hosts many nonprofits, universities, and hospitals — like Northeastern, BU, and Mass General — that do not pay property taxes.

-

These institutions occupy billions in real estate value, yet often contribute little directly to surrounding communities.

What About the PILOT Program?

PILOT stands for Payment In Lieu of Taxes.

The City asks large nonprofits to voluntarily contribute payments because they are exempt from regular property taxes.

Problems:

-

It’s voluntary, not mandatory.

-

Many large institutions fail to meet even the modest 25% contribution requests.

-

District 7 residents continue carrying the burden while nonprofits expand into the area.

How Are Taxes Impacting District 7 Residents?

-

Elderly homeowners face displacement as assessments climb.

-

Renters experience rent hikes as landlords pass tax increases onto tenants.

-

Small businesses feel squeezed by assessments, even while foot traffic fluctuates.

-

Black and Brown residents bear disproportionate burdens rooted in historical housing discrimination.

Suggestions: Making the Tax System Work for the People

1. Create Tax Relief for Vulnerable Homeowners

-

Expand tax deferral programs for seniors and low-income homeowners.

-

Strengthen property tax exemptions for longtime residents.

2. Reform Property Assessment Practices

-

Conduct equity audits on assessments in gentrifying neighborhoods.

-

Provide support for residents appealing unfair property valuations.

3. Demand Fair Contributions from Major Institutions

-

Enforce stronger PILOT standards tied to community benefits.

-

Condition major development approvals on institutions’ local investment.

4. Make the Budget Process More Transparent

-

Host District 7 Budget Forums.

-

Launch participatory budgeting where residents vote on how a portion of the city budget is spent.

-

Push for neighborhood-level budget reporting.

Fair Taxes, Fair Boston

District 7 residents deserve a system where public dollars work for the public good — funding schools, parks, health clinics, and affordable housing, not just growing gaps between neighborhoods.

Understanding where your taxes go is the first step.

Demanding fair investment is the next.

Donate to this campaign and vote for me:

Together, we can create a Boston where tax justice is racial justice, housing justice, and economic justice combined.